Met de Apple Card breekt een spannende tijd aan in de financiële sector, waarbij de nadruk van succes meer ligt op de klantervaring. Het draait om sneller geld overmaken, geen kosten, kleine cashbacks en mensen helpen bij het financieel gezond zijn en blijven. Apple brengt klanten dichterbij een volledig digitale reis waarbij de batterijduur van hun telefoon de belangrijkste zorg is. Het realiseert ook kostenbesparingen. Dus wat kunnen traditionele banken leren van Apple over het verbeteren van klantreizen en hun eigen verdienmodellen?

Apple took its first steps into the financial sector with the ground breaking invention of Apple Pay in 2014.

What is Apple Card?

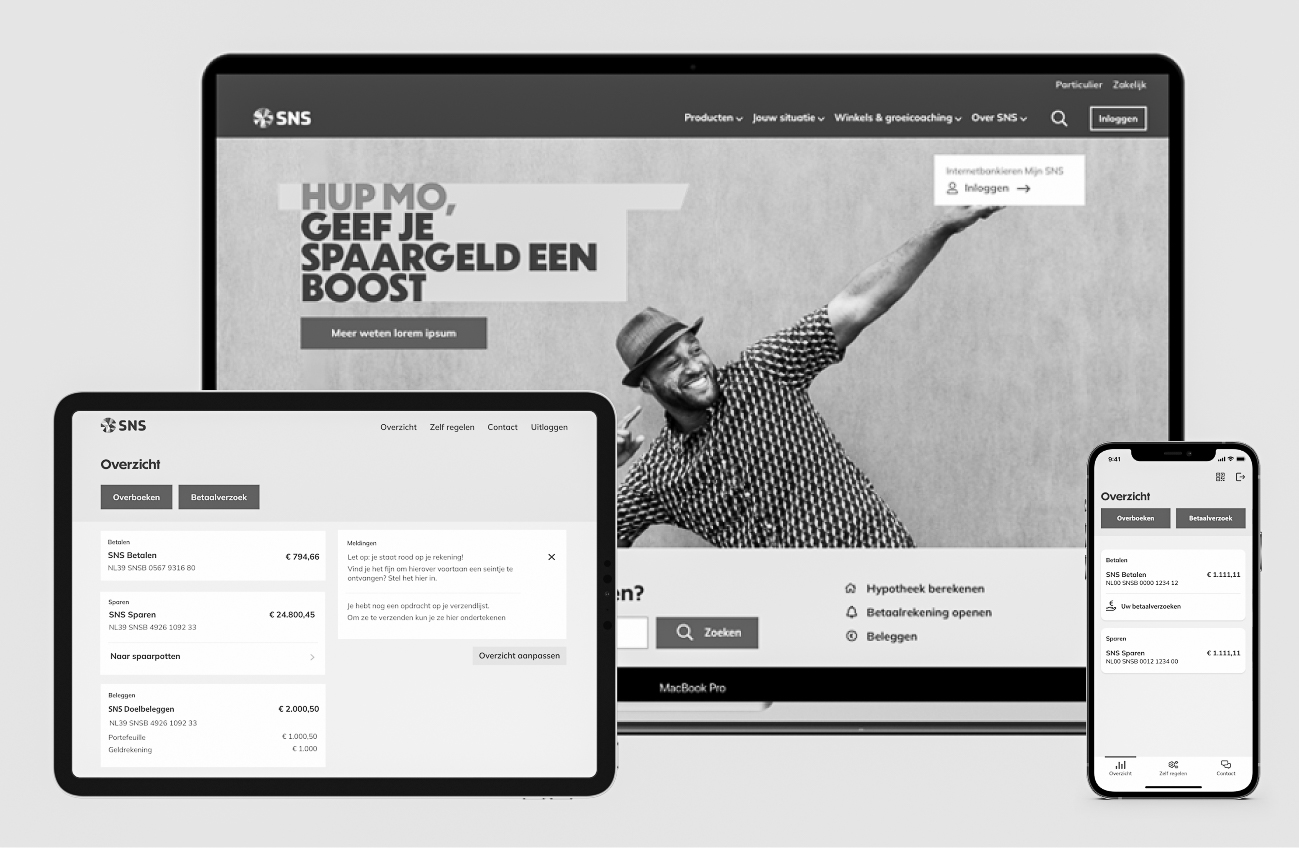

Apple Card is a new credit card issued by Apple in partnership with Goldman Sachs and Mastercard. It’s a digital credit card without any fees. It lives on your iPhone in the Wallet app, so there is no need for an extra website or other banking app. In the Wallet app, you can track what you’ve spent and where the transaction(s) took place. Alongside the digital credit card, Apple also provides a physical titanium card which can be used for merchants who don’t yet offer Apple Pay.

All spending is categorized with a colour and a label. This is applied to the graphs and the digital card changes colours so that consumers can spot trends at a glance. The idea is to help users be financially healthy by deeper analysis of the trends, checking the spending per category or even per merchant.

Features of Apple Card

Daily Cash

Every time someone uses Apple Card with Apple Pay to purchase Apple products and services, they will get 3% Daily Cash. This means 3% cash back on products or services purchased directly from Apple (in the Apple retail and online stores, the App store, iTunes etc). For every other purchase made with Apple Pay the user will receive 2% Daily Cash and 1% when a purchase is made with the physical card. This is a small incentive to motivate the use of digital only. Daily Cash is automatically deposited into the user’s Apple Cash card.

Apple Cash card

The Apple Cash card is basically a virtual prepaid debit card in the Apple Wallet which can be used to send, receive and request money from others with the use of the app ‘iMessage’. It’s comparable to services like Venmo and PayPal. You can use the money on this card to pay like a regular debit card, pay off your Apple Card or transfer it to your bank.

Safety

The physical Apple Card contains no privacy sensitive information like an account number, the expiry date and the CCV security code, which is the only information you need to make an online purchase. The only way to access this is through Face ID or Touch ID on the iPhone. This increases protection against hacking by criminals which is still a very high threat. According to Sixgill, criminals were already selling 23 million credit cards on the dark web in the first half of 2019.

Another safety feature is that users are notified of suspicious activity with the Apple Card. Every transaction is shown with the merchant’s name and the location where the transaction took place. Consumers can easily review transactions and choose to block or allow them. This further improves the protection towards (cyber) attacks, suspicious transactions and keeps consumers in control.

Completely digital

Currently most banks are working hard behind the scenes to fully digitalize debit card settings. The objective is to improve the customer experience in their banking apps to include options like setting up a new pin code, changing the limit or using the card in different countries. Since Apple Card lives on your phone, these settings are already digital and can be changed on the fly.

No fees

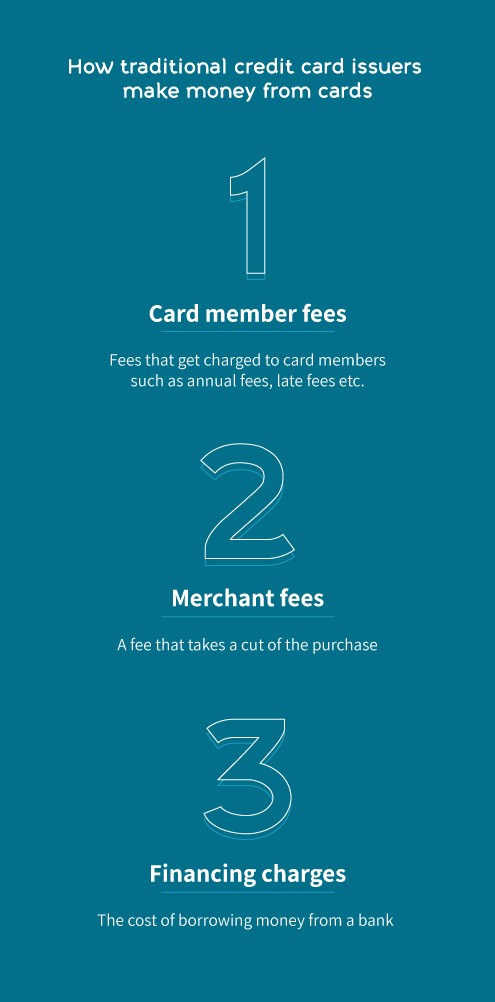

Apple Card has no fees. Not even hidden ones. Normal credit cards are loaded with all kinds of fees, for example an annual subscription or fees for withdrawing money in a foreign currency. Apple wants to make it a lot easier for consumers to pay off their balance by removing fees. Apple claims their goal with Apple Card is to provide interest rates that are among the lowest in the industry. This is great for customers but what does that mean for Apple’s earning model?

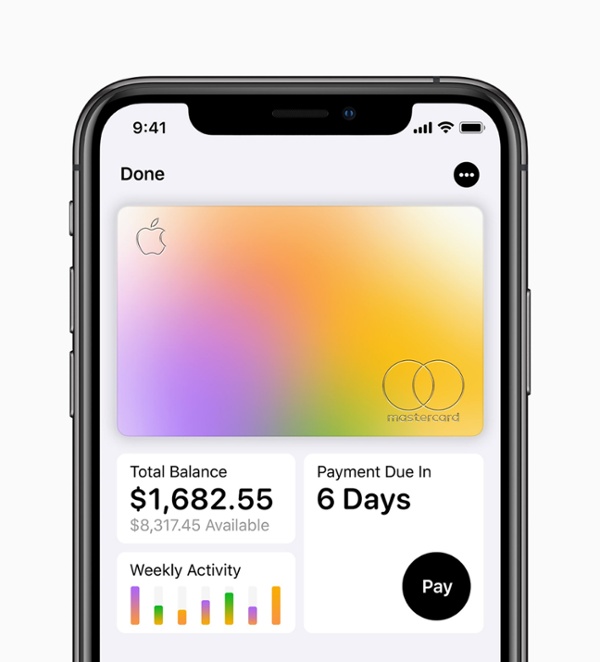

How will Apple make money with no fees?

The only costs you can see on the Apple Card webpage is the interest rate of 12.74% up to 23.74% which I think is quite high!

Considering the average is around 14% in the Netherlands.

And since Apple encourages you to pay less interest, by estimating the interest you’ll wind up paying real time on any payment amount, the theory is that you will be less likely to fall into debts. My thoughts are that Apple will be relying on the merchant fees that will be higher than the Daily Cash rewards to keep Apple Card sustainable but there is more. Apple is able to reduce their costs by saving on three key areas.

New user benefits

Normally companies spend a lot of money on customer acquisition. For example, they offer a discount or additional perks for onboarding new customers. Since Apple already has a big share of the consumer market with iPhone users, they could make savings on user benefits for onboarding new customers by promoting the Apple Card inside the Wallet App.

Customer support

Apple can also reduce their costs on Customer support. Most support, like how tos, can be done via the help of chatbots and because of the transaction transparency, users can easily identify their purchases instead of having to call a service agent for clarity.

Lower fraud rates

Fraud rates should be way lower because of better security. User sensitive information is not displayed on the physical card and every transaction with Apple Pay uses Touch ID and Face ID to verify the payment.

Besides making money with interest whilst reducing costs, it’s worth noting that the Apple Card will take you deeper into the Apple ‘ecosystem’. You will be less likely to switch phones. The App store and iCloud are already perfect examples of this.

How will partners make money?

An interesting article by CNCB shows that a rival bank of Goldman Sachs pulled out of the already advanced deal with Apple due to concerns that they wouldn’t be able to make money from the partnership.

So why did Goldman Sachs say yes to what it is calling the most successful credit card launch ever?

For starters, the bank will enhance its consumer base in the retail market. Secondly, by using customer data, they can easily promote their own businesses like trading, personal loans and investment banking. They are even working on a ‘next generation’ electronic trading platform. The objective is to put them one step ahead in the industry by freeing them from the struggle to migrate legacy technology that is slowing down so many other banks to innovate.

Should banks innovate or partner up?

Traditional banks know that they need to keep innovating and expanding to new markets to keep building their brands in the face of challengers like Apple. This choice involves expanding their customer experience by going further than what Apple Card is currently offering. Open-banking and PSD2 enabled solutions that bring customer value adding services and products for consumers could help with this expansion. Alternatively, they could shift their focus from innovation to providing the infrastructure and let companies like Apple do the rest.

At Keen Financials we love to innovate and contribute to your thinking on how to provide a better customer experience that ultimately brings value to the end user. Contact us to explore new customer journeys together to expand or shift the focus of your current business.